Crypto is in a bear market again, and Bitcoin critics are having a field day sowing seeds of doubt in investors’ minds. Therefore, you might be wondering, “Is Bitcoin still a good investment in 2022?”

Read on to find out our answer to this pressing question.

Bitcoin’s Bumpy Start Into 2022

After an exciting year in 2021, Bitcoin has been experiencing a bumpy start into 2022, crushing hopes that the price will get to the highly anticipated $100,000 mark soon. The current macroeconomic headwinds are creating a lot of uncertainty, which is why it is difficult to tell what will happen in the second half of 2022.

According to Coinmarketcap data, Bitcoin kicked off 2022 at $46,311.74 but dropped below $40,000 at the end of January. The price made a comeback going above $40K in February only to fall back below this mark at the end of the month. In March, Bitcoin’s price swung between $48,000 and $36,000, while April recorded a slightly better performance.

May, however, was a tough month for Bitcoin due to the interest rate hikes in the US as a consequence of fighting the non-transitory inflation. As it stands, experts expect the Federal Reserve to continue tightening rates going into 2023. That could mean that any meaningful recovery of the crypto market may be far off.

Also, trouble at Luna has affected the crypto markets at large, pushing Bitcoin’s price below $30,000. The Russia-Ukraine war is another factor that has disrupted global markets and, with it, the crypto market, increasing volatility. Terra’s “Luna Foundation Guard” (LFG) was responsible for dropping around 80,000 BTC into a weak market alone.

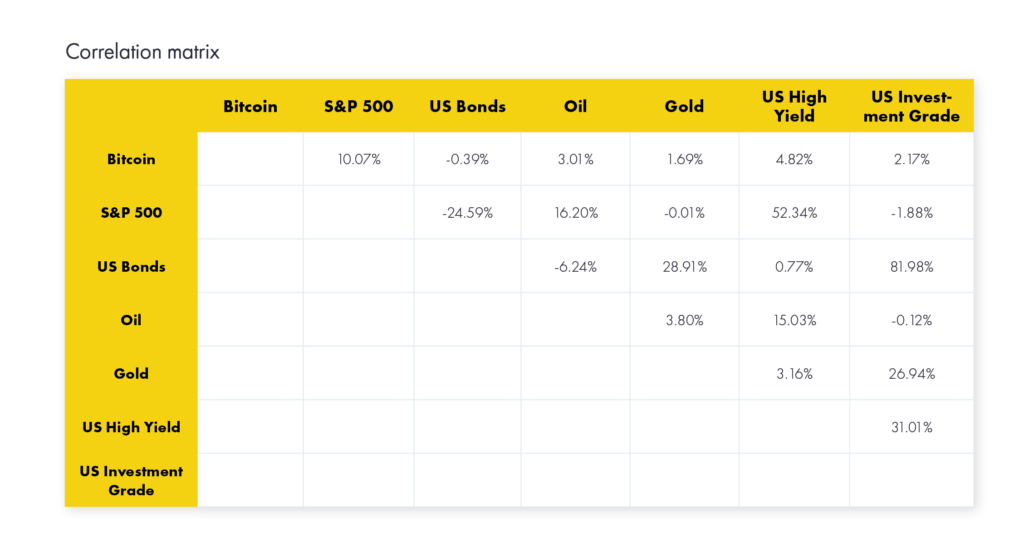

Moreover, investors’ risk appetite has diminished in 2022 as the US central bank has been raising interest rates. As a result, both the stock and crypto markets are negatively impacted, and for the first time, the correlation between the two has increased significantly.

With increasing correlation, Bitcoin has become less of a hedge against equity markets in the past six months.

Why Bitcoin Should (Probably) Still Be in Your Portfolio

We believe that you should keep Bitcoin in your portfolio even though it has suffered a ~37% hit year-to-date.

Remember, this isn’t the first time Bitcoin has taken a plunge. Bitcoin has experienced several price crashes before recovering and exceeding past all-time highs again.

Just last year, the value of Bitcoin dropped by 53% from over $63,500 to just under $30,000 from April to July. A few months later, in November, the price of Bitcoin rallied past its previous high to hit its current all-time high of over $68,700.

A similar situation occurred two years ago at the start of the pandemic. Within two days, the price of Bitcoin dropped by 50% in March 2020 to a recent low of $4,000 before recovering and rallying to $29,000 at the close of the year.

But if you’re wondering if bitcoin is still a good investment, here are several reasons to keep your doubts at bay.

Global Adoption is on the Rise

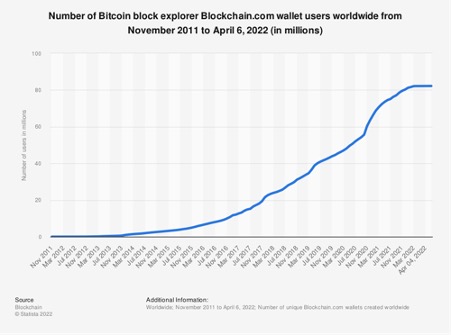

Bitcoin users (measured by Blockchain.com wallet users) have been on the rise since 2013. According to data on Statista, the number of wallets has grown from less than a million in November 2013 to over 81 million in April 2022.

Increased mainstream media coverage and support from technology leaders like Elon Musk and Jack Dorsey have propelled Bitcoin adoption forward. Additionally, El Salvador made Bitcoin legal tender in 2021, with the Central African Republic following suit in 2022, further boosting the adoption of Bitcoin as a means of payment and store of value (two crucial functions to become a “money”).

Online payment platforms like PayPal and Cash App have made BTC available to US customers, a move that is also driving adoption. Widespread adoption means that Bitcoin may achieve its role as money because more people will trust it as a medium of exchange.

More Bitcoin-Linked ETFs are Emerging

Investing in Bitcoin doesn’t only mean purchasing and holding coins in a personal wallet. There’s also a way to seek indirect exposure to its price.

Today, traditional investors can access financial products that they understand and invest in Bitcoin. These products are becoming more and more accessible across the globe. For instance, ProShares launched the first US Bitcoin futures-based exchange-traded fund (ETF) in October 2021. The ETF trades on the New York Stock Exchange and was the fastest ETF to top 1 bn USD in AuM.

Australia also got its first BTC ETF in May 2022. The ETF product is trading on Cboe Australia. Brazil, Canada, Germany, Sweden, Switzerland, Liechtenstein, and Jersey have also approved Bitcoin-linked exchange-traded products.

Institutional Investors & Public Companies are Embracing Bitcoin

Many of the biggest players on Wall Street are exposing their clients to Bitcoin, revealing their positive view of the digital asset. For example, Fidelity Investments enables US residents to allocate a portion of their 401(K) savings to BTC. Bank of America, Goldman Sachs, and Morgan Stanely are also embracing Bitcoin in various ways.

Additionally, publicly-traded companies like Tesla, Microstrategy, Square, and Galaxy Digital Holdings have added BTC to their balance sheets as a reserve asset. They’re embracing Bitcoin as a hedge against inflation and an alternative source of returns due to diminishing yields from the bond markets.

Bitcoin is the Best Performing Asset Ever

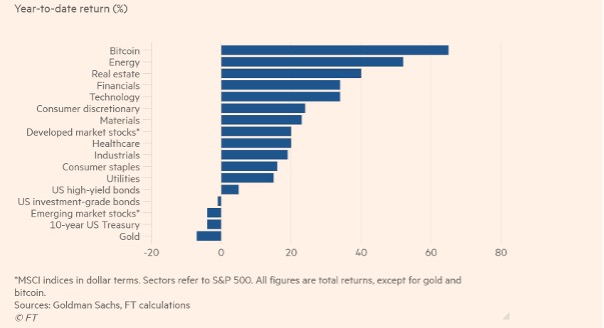

Bitcoin was the top-performing asset of 2021, according to the Financial Times. The cryptocurrency outperformed all major assets, including gold, energy, and technology.

But Bitcoin didn’t just have one good year.

Since its launch in 2009, the price of Bitcoin has risen from less than one cent to surpassing $68,000 in late 2021.

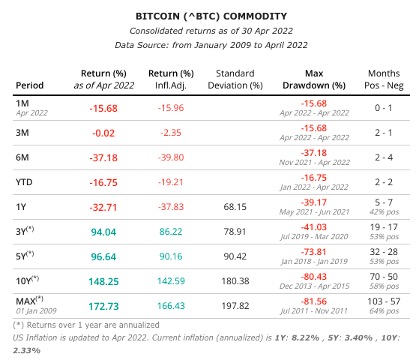

In the last five years, Bitcoin generated an average annualized return of over 96%, while over the course of the last decade, Bitcoin investors enjoyed over 148% average annual returns.

Bitcoin’s annual returns trump all major asset classes from commodities to stocks, making a strong argument for adding Bitcoin into the portfolio mix.

But it’s not the annual return figures that make bitcoin such a valuable portfolio addition.

Compared to traditional asset classes, bitcoin’s long-term correlations are low to negative, making bitcoin the ideal diversifying asset – having a positive impact on the portfolio Sharpe Ratio and the portfolio standard deviation despite bitcoin’s nosebleed volatility.

Bitcoin May Act as a Hedge in Times of Economic Uncertainty

In times of severe economic uncertainty, people can turn to Bitcoin, which has the ability to act as a hedge against failing a banking system, weakening currencies, and high levels of inflation.

Bitcoin is a decentralized digital currency that enables individuals and businesses to send and receive payments, even if the banking system or traditional payment rails are experiencing disruptions. Moreover, Bitcoin has been able to act as a store of value in countries with collapsing currencies or high levels of inflation.

Bitcoin Price Predictions are Optimistic

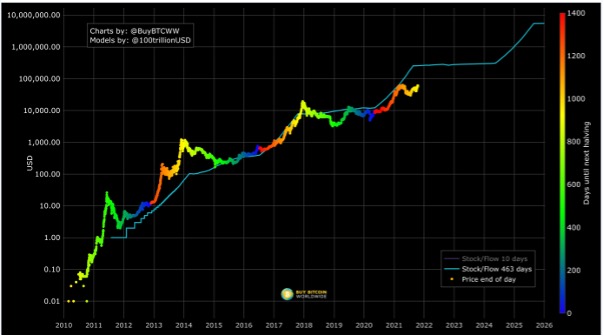

The popular Bitcoin price prediction model stock-to-flow (S2F) suggests that Bitcoin will surpass $100,000 in 2022. The price should remain above this mark until the next halving in June 2024. After the event, the price could climb above $1,000,000 in 2025 and 2026.

In the past, the S2F model has been fairly close to the real price, as shown in the graph below. It’s only been recent, where the Bitcoin’s price has deviated the farthest from the S2F model price.

If this prediction keeps on holding, then Bitcoin could hit $100,000 before the next halving. Hence, the current 2022 dip may be an opportunity for investors to buy low in anticipation of a rising future price.

Introducing the Iconic Funds Physical Bitcoin ETP

If you’d like to invest in Bitcoin but prefer to buy a regulated financial product that provides exposure to the price of Bitcoin, you could buy shares in the Iconic Funds Physical Bitcoin ETP (XBTI).

The Bitcoin ETP tracks Bitcoin’s price and is collateralized with physical BTC. Iconic stores the Bitcoin with a BaFin-regulated crypto custodian – Coinbase Germany GmbH. Purchasing this ETP will give you the claim to a predefined amount of Bitcoin.

The Iconic Funds Physical Bitcoin ETP trades under the ticker XBTI on Deutsche Börse Xetra, SIX Swiss Exchange, and Euronext Paris and Amsterdam.

About Iconic Funds

Iconic Funds is the bridge to passive and actively-managed exposure to crypto. Iconic Funds, via its subsidiaries, offers crypto asset ETP’s, diversified index funds, and alpha-seeking strategies for investors.

Our mission is driving the adoption of crypto assets. As the bridge for investors to gain exposure to Crypto Assets, Iconic’s licensed and regulated vehicles offer investors a menu of investment choices ranging from passive index exposure to actively-managed strategies. Iconic Funds removes the technical risks of crypto investing by offering investors trusted and familiar means to invest in crypto at industry-leading low costs.

The marriage of state-of-the-art technology, innovative investment products, and uncompromising professionalism places Iconic at the vanguard of crypto asset management.

Recent News

- Why Bitcoin’s Volatility Shouldn’t Scare You

- How Green Mining Will Become the Norm for Bitcoin Network

- How accurate is the Bitcoin Stock-to_Flow Model?

- How Layer 2 Solutions Are Helping Ethereum Scale

- Bitcoin Education Will Pave the Way for Hyperbitcoinization

Iconic in Press

- Das Investment: Kryptowährungen kommen 2022 im Mainstream an

- Private Banking Magazin, Bitcoin – das perfekte Beispiel für ein ESG-Investment?

- Institutional Money, Krypto-Manager steigt bei Family Office ein

- Morningstar, Iconic Funds Expands Product Range With a Physical Ethereum ETP

Recent Research Reports

- How did portfolios perform during the pandemic? ➡ Download here

- Analyzing the Primary Value Drivers of Leading Cryptocurrencies ➡ Download here

- How Effective are Common Investment Strategies with Bitcoin? ➡ Download here

- Investigating the Myth of Zero Correlation Between Crypto Currencies and Market Indices ➡ Download here

For further information, please visit deutschedastg

Legal Disclaimer

In no event will you hold ICONIC HOLDING GMBH, its subsidiaries or any affiliated party liable for any direct or indirect investment losses caused by any information in this article. This article is not investment advice or a recommendation or solicitation to buy any securities.

ICONIC HOLDING GMBH is not registered as an investment advisor in any jurisdiction. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein.

Our articles and reports include forward-looking statements, estimates, projections, and opinions which may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond ICONIC HOLDING GMBH’s control. Our articles and reports express our opinions, which we have based upon generally available information, field research, inferences and deductions through our due diligence and analytical process.

ICONIC HOLDING GMBH believes all information contained herein is accurate and reliable and has been obtained from public sources we believe to be accurate and reliable. However, such information is presented “as is,” without warranty of any kind.