Stay up to date with our monthly crypto overview:

- September was a historic month for Bitcoin as El Salvador became the first nation to adopt the cryptocurrency as legal tender.

- In the top ten crypto assets, a big winner this past month has been Solana, which is up an 38.57% despite the overall correction in crypto markets.

- Despite US financial regulators seemingly stepping up their efforts to regulate crypto assets, institutional interest in Bitcoin and other crypto assets has never been higher.

Crypto Market Overview

September was a historic month for Bitcoin as El Salvador became the first nation to adopt the cryptocurrency as legal tender.

Since September 7, Salvadorians can choose to pay for goods and services with Bitcoin or the US dollar. By mid-September, over 1.6 million citizens downloaded Chivo Wallet, the government’s official Bitcoin wallet.

El Salvador also became the first nation-state to buy and hold Bitcoin. President Nayib Bukele announced on Twitter that the Central American nation had purchased 700 BTC in total throughout September.

The days leading up to “Bitcoin Day” in El Salvador saw the price of Bitcoin (BTC) rally above $52,000 in the first week of September. However, Bitcoin came tumbling down as a result of global market uncertainty in light of the Evergrande saga playing out in China.

Evergrande, a publicly-traded Chinese real estate developer, expanded aggressively by borrowing more than $300bn (€255bn) but is now struggling to cover interest payments due to recently introduced borrowing limits for real estate developers in the People’s Republic.

In light of the sheer size of Evergrande, the systemic risk that the collapse of the company would pose to the Chinese property market and banking sector, global equity markets responded with a sharp drop. Crypto followed suit with a correction of over 20% in the price of Bitcoin and other leading crypto assets, although they have relatively rebounded in the days since.

Crypto Asset Performance Review

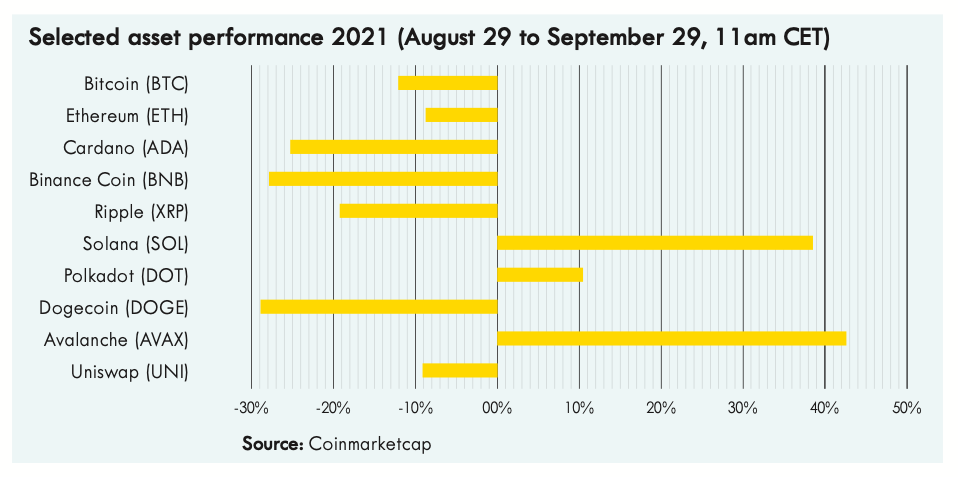

In the top ten crypto assets, a big winner this past month has been Solana (SOL), which is up an 38.57% despite the overall correction in crypto markets. The relatively new chain, which has emerged as a favorite among VCs and Crypto Twitter, has been able to attract developers to build DeFi protocols and launch NFT ventures on the next-generation blockchain, highlighting that it’s a real threat to Ethereum’s dominance in the dApp space.

Similar to Solana, Avalanche (AVAX) was also able to book significant gains (42.67%) while Polkadot’s price is up 10.46%, as developers and users are moving away from Ethereum (due to its high gas fees) to more scalable and affordable chains.

Bitcoin dropped 12.05% month-on-month, suggesting that despite being considered a safe haven asset in times of economic turmoil, the world’s leading cryptocurrency still behaves like a risky asset at times. Together with most leading digital assets, Bitcoin’s sharp price drop followed the Evergrande fallout.

Ether (ETH) dropped by 8.75%, while the likes of Cardano (ADA), Ripple (XRP), Binance Coin (BNB), Dogecoin (DOGE), dropped between 18% to 28% in value. Uniswap (UNI) closed the month 9.08% lower

Uniswap’s price correction was partly driven by a reported SEC probe into Uniswap developer, Uniswap Labs, as part of the financial regulator’s push into better understanding and potentially regulating decentralized finance (DeFi).

Looking at the performance of traditional asset classes, we can see Evergrande rattled equity markets across the globe when the company’s troubles were made public. Despite a relatively quick bounce back, the S&P 500 closed the month 3.89% lower while the MSCI World Equity Index dropped by 3.59%.

The price of gold (XAU) rallied following the Evergrande news as investors moved funds into the safe haven asset. Month-on-month, however, the precious metal has lost 4.07% of its value, continuing its poor performance this year.

US Treasuries were also in demand in September. Yields tightened as investors sought refuge from volatility in the equity markets. The S&P U.S. Government Bond Index is down 1.03% month-on-month.

Institutional Interest in Crypto

Despite US financial regulators seemingly stepping up their efforts to regulate crypto assets, institutional interest in Bitcoin and other crypto assets has never been higher.

Citigroup is reportedly waiting on regulatory approval to start trading Bitcoin futures on the Chicago Mercantile Exchange (CME). The US baking giant is also actively looking to hire staff for a London-based crypto trading team.

Swiss securities exchange, SIX, which is the home to numerous exchange-traded crypto products, has received regulatory approval to launch its digital asset exchange, SIX Digital Asset Exchange (SDX). The nod of approval from the Swiss financial watchdog, FINMA, allows SDX to launch regulated trading, settlement, and custody of crypto assets and digital securities.

On September 13, Deutsche Börse-owned derivatives exchange, Eurex, launched Bitcoin ETN Futures trading, marking the exchange’s first step into crypto derivatives.

The push for a Bitcoin ETF in the US has also continued this month, with Invesco and Galaxy Digital jointly filing for a physically-backed Bitcoin ETF, following the likes of Van Eck and Fidelity. While the SEC is yet to approve any crypto ETFs, the ongoing institutionalization of Bitcoin as an asset class suggests that it may only be a matter of time until a Bitcoin ETF will list on a major US exchange.

Bitcoin on Balance Sheets

MicroStrategy, led by outspoken Bitcoin advocate Michael Saylor, purchased an additional 5,050 BTC in September, bringing the publicly traded company’s Bitcoin holdings to 114,042 BTC worth $3.16 billion on the day of the announcement. The company purchased its coins at an average price of $27,713 per Bitcoin.

About Iconic Funds

Iconic Funds is the bridge to passive and actively-managed exposure to crypto. Iconic Funds, via its subsidiaries, offers crypto asset ETP’s, diversified index funds, and alpha-seeking strategies for investors.

Iconic Funds’ mission is driving the adoption of crypto assets. As the bridge for investors to gain exposure to Crypto Assets, Iconic’s licensed and regulated vehicles offer investors a menu of investment choices ranging from passive index exposure to actively-managed strategies. Iconic Funds removes the technical risks of crypto investing by offering investors trusted and familiar means to invest in crypto at industry-leading low costs.

The marriage of state-of-the-art technology, innovative investment products, and uncompromising professionalism places Iconic at the vanguard of crypto asset management.

Recent News

- Iconic Funds Receives Regulatory Approval for and Launches New Fund in Partnership with Coin Metrics, read here

- Iconic Funds’ Physical Bitcoin ETP Listing in Paris and Amsterdam on Euronext, read here

Iconic in Press

- ETF Magazine, The primary value drivers of Bitcoin and Ethereum, by Michael Geister, Head of Crypto ETPs

- Iconic Blog, An Update on Bitcoin’s Hash Rate, Dominik Poiger, Head of Product Management

- Börsen-Zeitung, Bitcoin hat nun Spielraum nach oben, Interview with Maximilian Lautenschläger, Co- founder and MP of Iconic and Michael Geister, Head of Crypto ETPs

- Fundview, Bitcoin, Ethereum & Co.: Which factors affect the value of cryptocurrencies?

- Der Fonds, Crypto Roundtable, Maximilian Lautenschläger, Co- founder and MP of Iconic Holding

Upcoming Webinars and Events

- HEDGEWEEK BETTER BUSINESS SUMMIT, October 07, 2021, Simonne Hurse, Head of Investor Relations

- IM | Power -FUNDFORUM INTERNATIONAL, 20-22 October, 2021, Maximilian Lautenschläger, Co founder and MP of Iconic

Recent Research Reports

- Analyzing the Primary Value Drivers of Leading Cryptocurrencies ➡ Download here

- How Effective are Common Investment Strategies with Bitcoin? ➡ Download here

- Investigating the Myth of Zero Correlation Between Crypto Currencies and Market Indices ➡ Download here

For further information, please visit deutschedastg

Legal Disclaimer

In no event will you hold ICONIC HOLDING GMBH, its subsidiaries or any affiliated party liable for any direct or indirect investment losses caused by any information in this article. This article is not investment advice or a recommendation or solicitation to buy any securities.

ICONIC HOLDING GMBH is not registered as an investment advisor in any jurisdiction. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein.

Our articles and reports include forward-looking statements, estimates, projections, and opinions which may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond ICONIC HOLDING GMBH’s control. Our articles and reports express our opinions, which we have based upon generally available information, field research, inferences and deductions through our due diligence and analytical process.

ICONIC HOLDING GMBH believes all information contained herein is accurate and reliable and has been obtained from public sources we believe to be accurate and reliable. However, such information is presented “as is,” without warranty of any kind.