Key Takeaways

- Massive dislocations within crypto derivatives markets in consequence of the FTX debacle are indicative of a short-term bottom

- Fire-Sale valuations and the fact that we might have passed the peak of maximum hawkishness by the Fed after the recent US inflation data, increase the probability of a cyclical bottom in crypto markets

Massive dislocations in derivatives markets

(We have recently covered the events that led to the FTX debacle in more detail here.)

In consequence of the latest debacle surrounding the major crypto exchange FTX and its parent company Alameda Research, crypto markets have sold off significantly. While Bitcoin has lost another -17% since the start of the week, the FTX Token (FTT) has lost -85% so far.

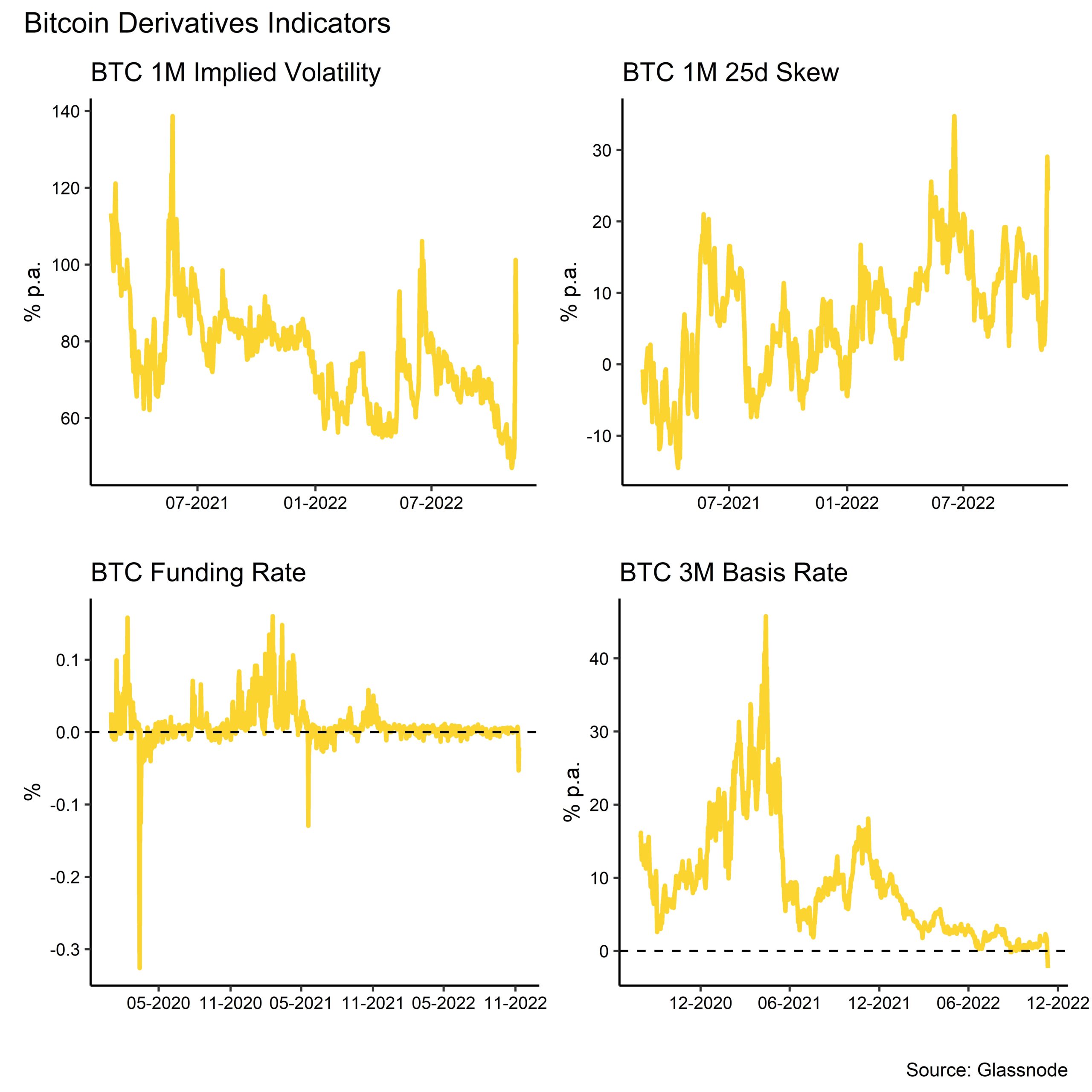

The sell-off was accompanied by heavy dislocations in crypto derivatives markets. More specifically, put-call volume ratios for Bitcoin options on the prime crypto derivatives exchange Deribit spiked, indicating that traders were significantly hedging downside risks via puts. At one point on Tuesday this week, there were 1.6 x more puts traded than calls on Bitcoin.

This is also supported by the fact that the options skew increased significantly in favor of puts and the fact that implied volatilities in Bitcoin options spiked.

In addition, funding rates on perpetual futures contracts in Bitcoin went heavily negative as did the 3-month basis rate. Both of these phenomena imply that traders largely preferred short over long contracts.

The 3-month basis even went negative, signaling that market expectations for the next 3 months became relatively pessimistic. The 3-month basis is the difference between a 3-months futures contract and the current spot price of Bitcoin. Going long spot and shorting the delta-equivalent 3-months futures contract is often referred to as “carry trade” since the futures contract used to trade at heavy premia relative to the spot price.

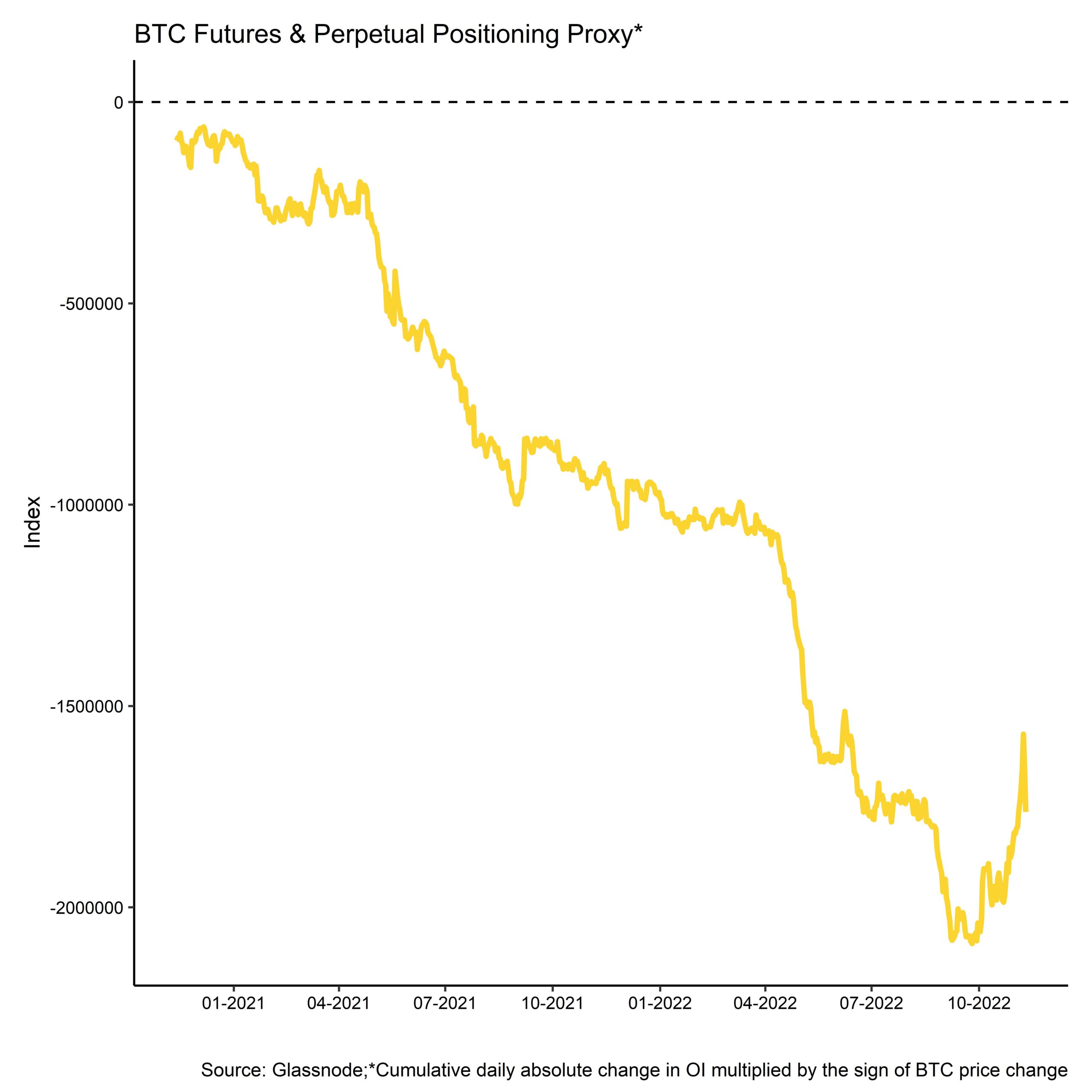

This has recently changed in consequence of the recent market dislocations to the extent that traders massively unwound these carry trades. This is also evident in our “Bitcoin Futures & Perpetual Positioning Proxy” that shows a significant decrease in Bitcoin net short positioning on a daily basis. Non-commercial traders are usually net short Bitcoin futures & perpetuals on account of the carry trade.

Apart from the abovementioned dislocations, there was a very low dispersion among Altcoins relative to Bitcoin, signaling that the market was rather trading on systematic factors than on coin-specific factors – something one usually observes near local bottoms.

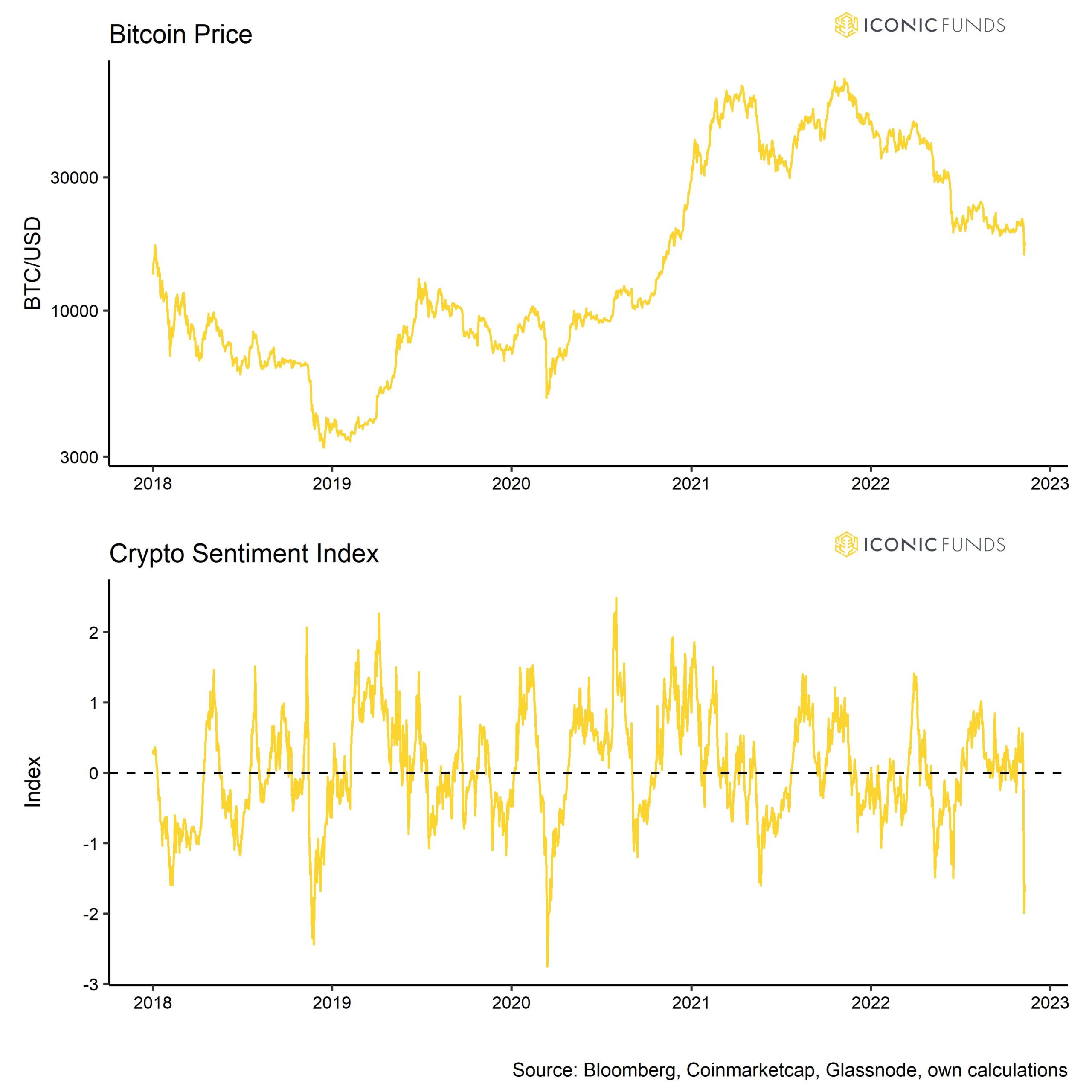

We have recently combined 15 metrics to an aggregate “Crypto Sentiment Index” that even signals a higher degree of bearishness than during the LUNA crash in June 2022. All in all, these metrics are currently indicative of a short-term bottom.

The “Crypto Sentiment Index” will also be part of our new weekly report that we are planning to release by the end of November on a regular basis.

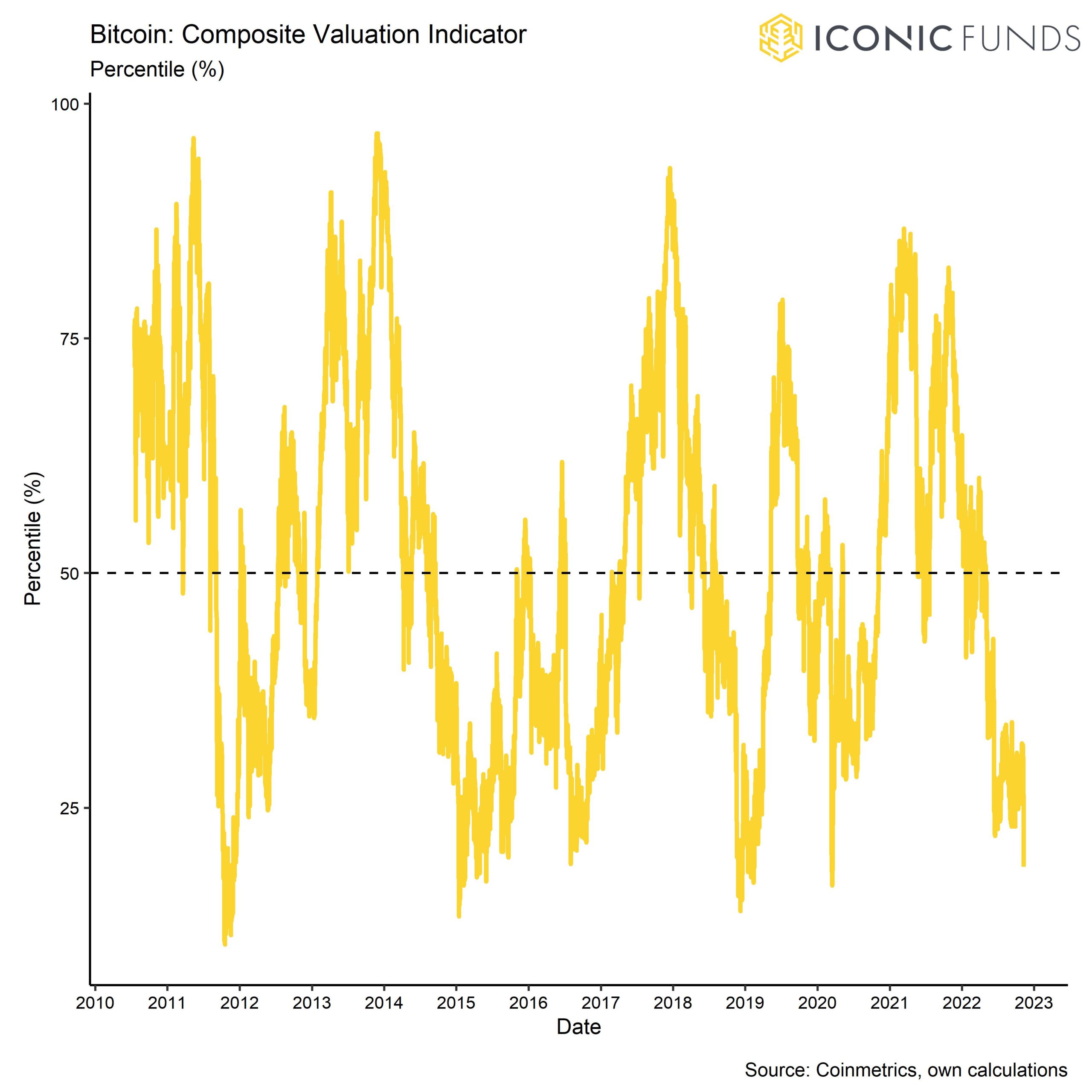

In combination with “fire-sale” valuations, we think that there is an increasing probability of a cyclical bottom in Bitcoin and cryptoassets in general.

The latest below-consensus US inflation data support this case even more from a macro perspective since they imply that we might have passed the peak of “maximum hawkishness” by the Fed. We have covered this investment hypothesis in greater detail in our latest “Crypto Market Intelligence” as well (see here).

Bottom Line: In general, we think that the risk-reward ratio has improved significantly following the latest events and that this might be an attractive environment for investors to increase their strategic exposure to cryptoassets.

Stay humble and stack Sats,

About Iconic Funds

Iconic Funds is the bridge to crypto asset investing through trusted investment vehicles. We provide investors both passive and alpha-seeking strategies to crypto, as well as venture capital opportunities.

We deliver excellence through familiar, regulated vehicles offering investors the quality assurances they deserve from a world-class asset manager as we champion our mission of driving crypto asset adoption.

Recent News and Articles

- Institutional Crypto Adoption: Why & How Institutions Are Going Crypto

- Crypto Portfolio Composition: How Different Portfolios Have Performed During the Recent Bull and Bear Markets

- Tailor-Made Crypto Funds: How the Iconic Quant Solutions Team Enables Investors to Earn Target Returns

- How to Invest in Ethereum (ETH): A Guide for Professional Investors

- The Case for Actively Managed Investment Strategies in the Crypto Markets

- How to Invest in NFTs: A Guide for Professional Investors

- Why Bitcoin’s Volatility Shouldn’t Scare You

- How accurate is the Bitcoin Stock-to_Flow Model?

Iconic in Press

- ETF stream: White-label issuers in Europe quietly tripled in a week

- ETF strategy: Iconic Funds debuts world’s first ApeCoin crypto ETP

- Das Investment: Kryptowährungen kommen 2022 im Mainstream an

- Private Banking Magazin, Bitcoin – das perfekte Beispiel für ein ESG-Investment?

- Institutional Money, Krypto-Manager steigt bei Family Office ein

- Morningstar, Iconic Funds Expands Product Range With a Physical Ethereum ETP

Recent Research Reports

Cryptoassets and the Macroeconomy: Can macro factors explain the price of Bitcoin?

Analyzing the Primary Value Drivers of Leading Cryptocurrencies ➡ Download here

How Effective are Common Investment Strategies with Bitcoin? ➡ Download here

For further information, please visit deutschedastg

Legal Disclaimer

The material and information contained in this article is for informational purposes only. Iconic Holding GmbH, its affiliates, and subsidiaries are not soliciting any action based upon such material. This article is neither investment advice nor a recommendation or solicitation to buy any securities. Performance is unpredictable. Past performance is hence not an indication of any future performance. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein. Our articles and reports include forward-looking statements, estimates, projections, and opinions. These may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Iconic Holding GmbH’s control. We believe all information contained herein is accurate, reliable and has been obtained from public sources. However, such information is presented “as is” without warranty of any kind.