Our monthly crypto overview for March:

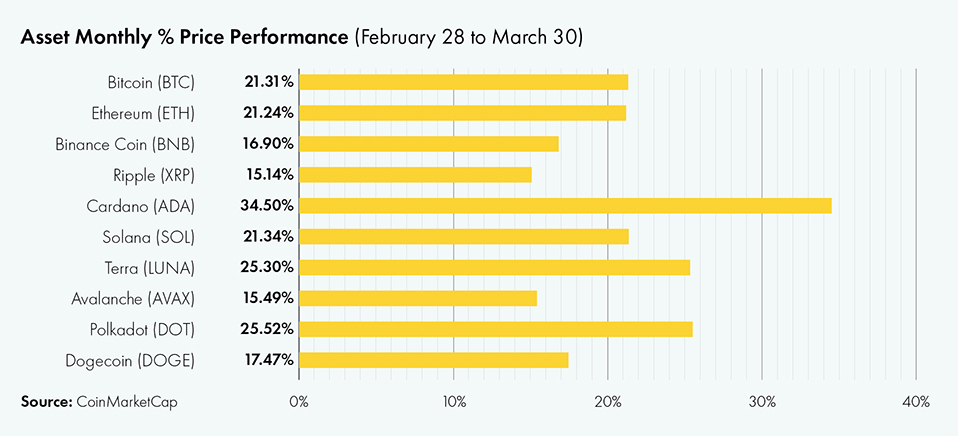

- The crypto markets rallied substantially in March, booking double-digit percentage gains.

- Bitcoin and Ether are up 21.31% and 21.24%, respectively.

- The top outperformer among the leading crypto assets was Cardano (ADA).

Crypto Market Overview March

Following a volatile February, affected by the war in Ukraine and high reported inflation figures, the crypto markets showed resilience in March, booking double-digit percentage gains across all leading crypto assets.

The two largest cryptocurrencies by market capitalization, Bitcoin (BTC) and Ether (ETH), rallied by 21.31% and 21.24%, respectively.

As high inflation sweeps major global economies, more investors recognize Bitcoin’s power as a store of value and hedge against high inflation. Moreover, U.S. President Biden’s executive order to regulate digital assets was largely taken positively by the crypto markets.

The price of Bitcoin has also been pushed higher by the Luna Foundation Guard (LFG) buying BTC to act as a reserve currency for Terra’s decentralized stablecoin TerraUSD (UST).

According to Do Kwon, the CEO of LFG, who leads the Terra project, the foundation has purchased over $1 billion in Bitcoin since January. The Bitcoin reserves will be used to stabilize the price of UST, which uses a token minting and burning process to maintain its dollar peg.

“The reason why we are particularly interested in Bitcoin is because we believe that [it] is the strongest digital reserve asset. UST is going to be the first internet native currency that implements the Bitcoin standard as part of its monetary policy,” Kwon told Bloomberg.

At the same time, the price of Ether (ETH) has benefited from a drop in gas fees as Layer-2 scaling solutions are experiencing increasing adoption and as the protocol moves closer to Ethereum 2.0.

Crypto Performance Overview March

March was an excellent month for crypto asset investors as they saw their investments make double-digit percentage gains.

Bitcoin and Ether led the way, booking over 21% month-on-month returns. Next-generation Layer-1 chains, such as Solana (SOL), Terra (LUNA), and Avalanche (AVAX), followed suit, closing the month 21.34%, 25.30%, and 15.49% higher, respectively.

The two market-leading exchange tokens – Binance Coin (BNB) and FTX Token (FTT) – also booked hefty gains, rallying by 16.90% and 21.10%, respectively.

The top outperformer among the largest crypto assets by market capitalization was Cardano (ADA), which rallied by 34.50% after the venture announced that it has become EVM-compatible through the Milkomeda EVM sidechain, enabling Ethereum DApps to be deployed in the Cardano ecosystem.

Stocks rallied as the prospect of a resolution to the Ukraine war is starting to look more likely, with the S&P 500 Index gaining 5.90%. Conversely, U.S. Treasuries, measured by the S&P U.S. Government Bond Index, closed the month -3.65% lower.

Like Bitcoin, Gold (XAU) managed to fulfill its role as a safe haven asset, booking substantial gains in February and the first half of March as uncertainty surrounding the Ukraine war was rocking the markets. However, after a peak of $2,050, the precious metal dropped back down to $1,920, recording only a small month-on-month gain of 0.36%.

Institutional Interest in Crypto

The CME Group has announced the launch of new cryptocurrency derivative products, adding options on Bitcoin and Ether micro futures to its suite of crypto products. “The launch of these micro-sized options builds on the significant growth and liquidity we have seen in our Micro Bitcoin and Micro Ether futures,” said Tim McCourt, CME Group Global Head of Equity and FX Products.

Goldman Sachs announced plans to offer investors access to Ethereum’s cryptocurrency, Ether (ETH), through a fund issued by Galaxy Digital Holdings. The minimum investment size will be $250,000 as the bank targets large clients with this new service.

Bitcoin on Balance Sheets

NASDAQ-listed MicroStrategy, led by Bitcoin advocate Michael Saylor, has added more Bitcoin to its balance sheet after securing a Bitcoin-backed loan from Silvergate Bank (SI) to purchase more BTC. MicroStrategy is one of the largest Bitcoin holders in the world.

Canadian fintech company Mogo (MOGO) has launched a VC arm, Mogo Ventures, to manage its mostly crypto-focused investments. In addition to equity stakes in Coinsquare and several web3 platforms, the company also reportedly holds C$1.7 million ($1.36 million) of Bitcoin (BTC) and Ether (ETH) on its balance sheet.

About Iconic Funds

Iconic Funds is the bridge to passive and actively-managed exposure to crypto. Iconic Funds, via its subsidiaries, offers crypto asset ETP’s, diversified index funds, and alpha-seeking strategies for investors.

Our mission is driving the adoption of crypto assets. As the bridge for investors to gain exposure to Crypto Assets, Iconic’s licensed and regulated vehicles offer investors a menu of investment choices ranging from passive index exposure to actively-managed strategies. Iconic Funds removes the technical risks of crypto investing by offering investors trusted and familiar means to invest in crypto at industry-leading low costs.

The marriage of state-of-the-art technology, innovative investment products, and uncompromising professionalism places Iconic at the vanguard of crypto asset management.

Recent News

- Why Bitcoin’s Volatility Shouldn’t Scare You

- How Green Mining Will Become the Norm for Bitcoin Network

- How accurate is the Bitcoin Stock-to_Flow Model?

- How Layer 2 Solutions Are Helping Ethereum Scale

- Bitcoin Education Will Pave the Way for Hyperbitcoinization

Iconic in Press

- Das Investment: Kryptowährungen kommen 2022 im Mainstream an

- Private Banking Magazin, Bitcoin – das perfekte Beispiel für ein ESG-Investment?

- Institutional Money, Krypto-Manager steigt bei Family Office ein

- Morningstar, Iconic Funds Expands Product Range With a Physical Ethereum ETP

Recent Research Reports

- How did portfolios perform during the pandemic? ➡ Download here

- Analyzing the Primary Value Drivers of Leading Cryptocurrencies ➡ Download here

- How Effective are Common Investment Strategies with Bitcoin? ➡ Download here

- Investigating the Myth of Zero Correlation Between Crypto Currencies and Market Indices ➡ Download here

For further information, please visit deutschedastg

Legal Disclaimer

The material and information contained in this article is for informational purposes only.

Iconic Holding GmbH, its affiliates, and subsidiaries are not soliciting any action based upon such material. This article is neither investment advice nor a recommendation or solicitation to buy any securities.

Performance is unpredictable. Past performance is hence not an indication of any future performance.

You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein.

Our articles and reports include forward-looking statements, estimates, projections, and opinions. These may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Iconic Holding GmbH’s control.

We believe all information contained herein is accurate, reliable and has been obtained from public sources. However, such information is presented “as is” without warranty of any kind.