Crypto assets are showing increasing reason for long-term investors to have and to hold them, but what’s the best, and safest, way to do this?

CryptoScout by Eleanor Haas, innovation navigator, Partner of Iconic Holding, Managing Director of The Calyx Group, Advisor to Astia Angels, and Director, Keiretsu Forum Mid-Atlantic.

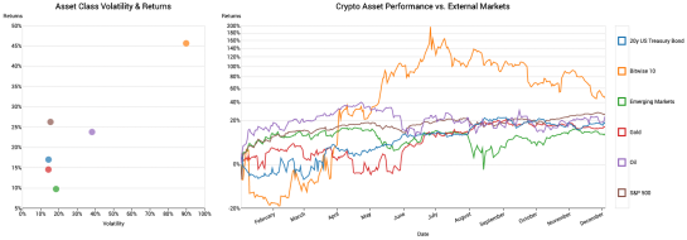

Crypto assets had one of their best years in 2019. Research by Digital Assets Data found the top ten cryptos in terms of market cap outperformed other major asset classes, such as gold, oil and equities.

It’s still early days for the technology. The market is largely unregulated, although massive improvements have been made, and crypto remains highly volatile and largely speculative. Nonetheless, crypto investment is being recommended by many top advisors.

Conservative exposure can be highly beneficial, say advisors, because of crypto’s asymmetric risk. Digital assets are “uncorrelated to any other asset class” according to David Martin, chief investment officer at U.S. asset manager Blockforce Capital, “so they do well to boost diversification in our highly correlated and ever-increasing global markets.”

A recent study by Yale economist Aleh Tsyvinski was reported by Bitcoinist to have found that about 6% of every portfolio should be allocated to Bitcoin in order to achieve a higher potential return. The allocation should never be less than 4%, and even staunch opponents would do well to invest at least 1% of their assets in crypto for diversification purposes.

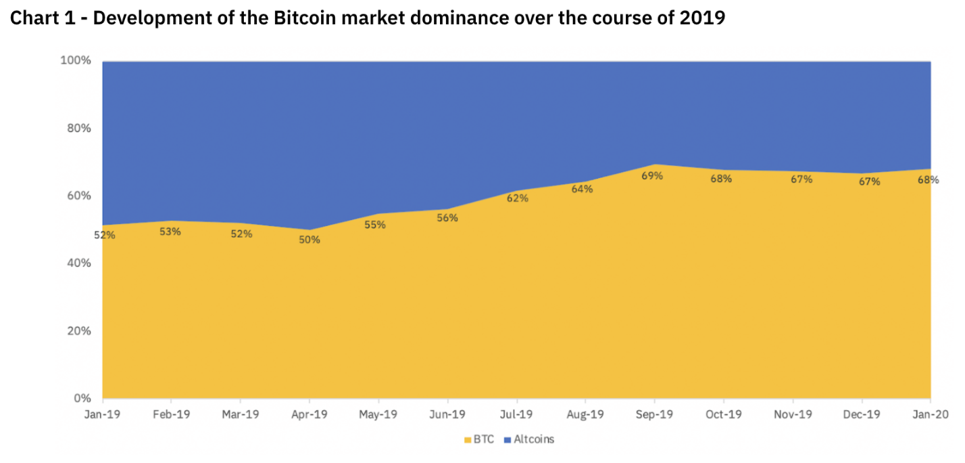

Within the crypto asset class, Bitcoin is always seen as the prime prospect because of its dominance. Designed as a means of peer-to-peer exchange but now more regarded as a digital store of value, Bitcoin is joined by more than 5,000 “altcoins”, yet, it remains dominant with a 64.3% market share at the time of this writing. Bitcoin is dominant because it was the adopted mover and because it has attracted the lion’s share of media and investor attention.

Binance Research 1.22.20 courtesy of Lou Kerner

But asset class dominance does not necessarily make Bitcoin the best investment. There are many unique value drivers for each of the crypto assets and various blockchains, such as with Ethereum and EOS. Even within the crypto asset class, diversification can have value.

Understanding Crypto Value Drivers

Understanding the scope of the brave new crypto universe is key to understanding crypto investment value drivers. To borrow Michael Lewis’s phrase for Internet technology, cryptocurrency is a new, new thing – part of a new, new kind of economic ecosystem. George Gilder, the economist/writer, calls this the cryptocosm.

Each crypto coin is part of an individual ecosystem within the global cryptocosm. This ecosystem affects the coin’s intrinsic value. It consists of three principal components:

- A reward system that fuels the ecosystem – a crypto coin, or financial asset, and/or a utility token, both of which are decentralized applications, or DApps.

- An enabling blockchain protocol, or platform – a decentralized distributed ledger that facilitates peer-to-peer transactions – which is public.

- A community of stakeholders – miners, developers, users, exchanges and coin/token holders.

Each of the three elements is integral to the other two. You can’t have one without the other! Crypto coins and tokens reward community members for participation. The blockchain platform implements the reward system and any products and services, which it delivers. The community creates the blockchain, develops the software, buys products or services the blockchain delivers and funds the business.

A centralized blockchain platform with no coins, with or without tokens, can be used as a private enterprise system serving permissioned stakeholders. The centralized system is technology investing, not crypto asset investing, but it creates demand for the platform. This in turn adds to the intrinsic value of any cryptocurrency that may be part of the platform’s cryptocosm if it has one.

Investing in Crypto

You can invest in either one of two ways: Buy coins, a laborious process exposed to risk, or use traditional investment vehicles, which is more familiar for traditional investors. First, buying coins.

Buying Coins

Choosing the crypto to buy requires an assessment of its value drivers. The best-known value driver is investor and user demand. This, in turn, is determined at least in part by demand for use of the asset’s underlying platform because usage generates demand for the asset, participation by community members and, thus, builds value for that particular crypto ecosystem. Growing usage assures sustainability and stability.

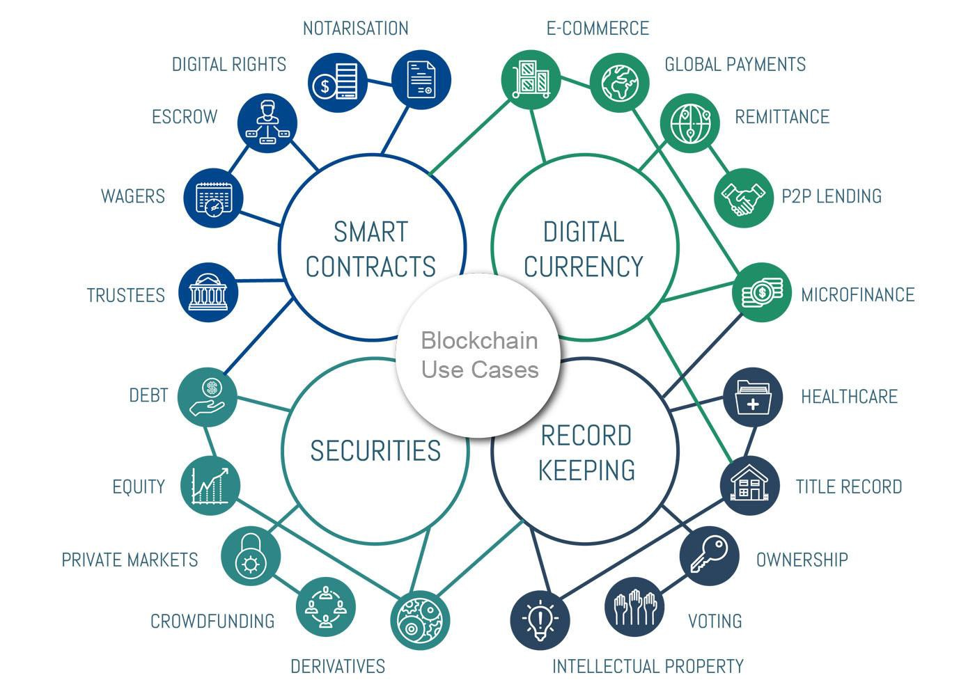

Three crypto use case examples.

- Bitcoin cryptocurrency, enabled by the Bitcoin blockchain, was of course created to eliminate the cost and control of third party intermediaries by enabling peer-to-peer value transfers, or payment systems. In countries like Venezuela, with scandalous inflation, it’s invaluable as an alternative to fiat, or government-issued money; in countries with large numbers of unbanked, it serves as a cost-effective way to handle remittances; for merchants with trans-border transactions, it’s equally cost-effective as a payment system, and it is growing steadily in retail acceptance both online and off.

- Ether, enabled by the Ethereum platform, differs radically from Bitcoin because it has a use case beyond that of a digital currency. It has intrinsic value for developers who want to run their own applications on Ethereum and is the platform of choice for many new cryptos and private enterprise systems – all of which fosters continuing demand.

- The Binance coin, enabled by the Binance exchange, allows you to redeem the coin for reduced trading fees on the platform, enhancing user loyalty of the exchange. Additionally, the coins may be staked by users to participate in a lottery to gain access to Initial Exchange Offers (IEO’s) on Binance. Further, Binance burns coins that are redeemed to it on a quarterly basis, reducing the overall supply of the coin over time to drive further value to the coins holders.

The scope of potential cases is extensive

Image: Peter Bergstrom

Once you’ve assessed and chosen a crypto, you need to research and decide three things: a private key, a wallet and a crypto marketplace.

Acquiring, Holding and Trading Crypto

- The Private Key. Crypto coins are programmed code. They exist in digital space and only in digital space. You own them through your private key, a unique number/address that must remain secret, be backed up and be protected from accidental loss because it’s your only evidence of ownership.

- The Wallet. These crucial digital keys are software that is created and stored by the wallet. It may be stored by a software service in the Bitcoin market – these require special safety measures – stored on your desktop, on a hardware wallet – devices connected to your computer by a USB cable – and/or on a paper wallet for offline storage.

- A Crypto Marketplace. The marketplace is where you buy, trade and sell crypto. Typically, you will buy it from a crypto exchange or financial marketplace. Of more than 500 estimated exchanges to exist, 259 are tracked on CoinMarketCap. Easy to set up and not locally regulated, they seem to come and go, so choose carefully.

Issues to be considered in choosing the one right for you:

- Supported countries.

- Amount of fees for exchange transactions.

- The number of supported coins.

- Security.

- Liquidity – determined by volume.

- Fiat or only crypto accepted.

- Customer support.

- Trading pairs available.

Coinbase (San Francisco-based) is the most beginner-friendly, has among the lowest fees and accepts fiat. Two other popular exchanges, Binance and Bitfinex accept some fiat, but mostly only crypto.

An alternative is LocalBitcoins, where you can interact directly with other users on purchases and trades. It’s private, the only way to buy bitcoins in some countries, and allows many payment methods. However, there are scams, so beware, and you may pay a higher fee to compensate for the privacy.

Finally, you can buy Bitcoin at an increasing number of Bitcoin ATMs and send it to your wallet. There are now about 5,000 of these in over 90 countries.

The Easier Way: Crypto Investing on the Shoulders of Pros

Over the past five years or so, professional asset managers have begun to create opportunities that allow investors exposure to crypto investments without having to manage the digital assets themselves.

- If you live in Switzerland or have a Swiss passport, you can consider a Bitcoin Certificate on the Swiss Exchange – a portfolio of at least 60% Bitcoin with the balance in USD, managed by an algorithm that anticipates Bitcoin price trends.

- New York-based Grayscale Investments, the largest digital asset manager in the world, offers 10 crypto investment products to institutional and accredited investors. (73% of its investment is from institutions.) One of these the Grayscale Bitcoin Trust is a product individual investors can buy and sell in their own brokerage accounts, as it trades publicly, albeit on an OTC market. The downside is high premiums in addition to an annual fee along with the risk factors associated with the volatility of the crypto market. Cost can outrun returns depending on the value of underlying Bitcoins.

- Crypto Hedge Funds. PWC estimates that there were 150 active crypto hedge funds a year ago and that collectively they managed $1 billion is AUM. They are small: most are under $10 million in AUM. Management experience varies widely. According to Crypto Fund Research, crypto funds have underperformed cryptocurrencies in bull markets and outperformed in bear markets. The overall result since 2016 has been positive.

- Crypto Index Funds. Even Warren Buffet likes index funds. “A very low-cost index is going to beat a majority of the amateur-managed money or professionally managed money,” he has said.

An index fund involves investing in an underlying assets of a benchmark index. For crypto assets today, index funds are available to professional or qualified investors, however retail investor facing products, such as Mutual and Exchange Traded Funds (ETFs) are not yet available due to regulatory issues. Jack Bogle, founder of Vanguard Investments and the pioneer of indexing, warns that being able to trade an index like a stock creates temptations to trade that can be damaging because of poor timing and increased expenses. At the same time, the two can be used in combination.

Crypto index fund offerings have grown rapidly in the past few years. Crypto index funds offer at least three major investor benefits:

- Risk Management Through Diversification. Diversification allows investors potential increases in returns from a new and highly volatile asset class without taking additional risk, by spreading the risk across a portfolio of diverse cryptos.

- The Convenience of a Simple Process. It’s easy to manage such an investment. No need to spend time analyzing specific assets, numerous asset classes and portfolios. No need for private keys, wallets or exchanges.

- Peace of Mind. No fear of losing your investment by losing your private key or having your wallet hacked at an exchange.

The secret of success? Choosing the right crypto index fund. Performance depends which cryptos are constituents and how each is weighted. You have to look at the top coins in the market to see whether any have been left out or any outlier included and find out the rationale. You also need to assess the methodology. Are the same people choosing the constituents and trading? Or was index creation outsourced to specialists? What are the credentials of the people who created the index? Those doing the trading?

To Invest or Not to Invest; That is the Question

Crypto investing is both the best of opportunities and the worst of risks. It’s no more right for everyone than any other investment. If you decide your situation warrants the risk, the best approach is to be well-armed with information – especially information from experienced crypto investors.

# # #

This article is strictly for educational purposes and isn’t to be construed as financial advice.

Eleanor Haas is Managing Director of The Calyx Group, an Iconic Holding partner. She believes passionately in a future where the crypto ecoysystem helps to reshape society for the better – economically, socially and culturally.